Why Can't We Just Sit Still?

Understanding Action Bias and Making More Rational Decisions Through Patience

If you have two minutes, can you please fill out this feedback form? This will help me improve my writing and create better content.

☀️ A Summer Dilemma: To Act or Not to Act?

Every summer in London, I face the same dilemma.

It's the weekend, and after a hectic week, I’ve planned a lazy day on the couch. I’ve been dreaming of this moment all week.

But then, Saturday morning arrives with the sun shining brightly.

Kids are playing, birds are chirping, and the ice cream van’s jingle is irresistible. It’s like a scene straight out of the Shire from Lord of the Rings. The only thing missing is Gandalf rolling in on his cart with fireworks.

Suddenly, guilt creeps in. How can I sit inside when the world outside is so inviting? I don’t have a plan, and I know stepping out will exhaust me, but the urge to act is overwhelming.

So, I do. And inevitably, I regret it.

Every time, I face two choices: a) Stay put; or b) Do something. More often than not, I choose action, driven by a need to feel in control—even when it’s irrational.

And that’s the topic for today—action bias—what it is, why it happens, and most importantly, what you can do about it.

We've got great flexibility and a certain discipline in terms of not doing some foolish thing just to be active - discipline in avoiding just doing any damn thing just because you can't stand inactivity.

— Charlie Munger

🧐 Unpacking Action Bias: Why Do We Feel Compelled to Act?

What drives us to take action, even when it’s unnecessary? Enter action bias.

Action bias is our tendency to favour action over inaction, even without evidence it will lead to a better outcome.

Picture this: it’s a hectic morning, and you’re running late for work. You rush to the lift, only to see someone has already pressed the button. Yet, your finger instinctively follows suit, pressing it again. That’s action bias... quietly at play.

It’s like an automatic reflex instead of rational thought.

Think of goalkeepers during a penalty kick. They often dive left or right, yet statistically, they’d be better off standing still.1

If only everyone’s coach was Shahrukh Khan.

We act because it feels like we are in control. But knowing this, how can we use it to our advantage? Stay tuned, because understanding why it happens is the first step.

🚨 Quick sidebar: Enjoying what you're reading? Bet you've got a friend who would too. Share and help me grow this community.

Psttt, they will also get a free copy of my ebook, Framework for Thoughts, when they sign up!

🤔 The Roots of Action Bias: Why Are We Wired to Act?

Why do we feel compelled to act, even irrationally? Let’s break it down.2

🧬 Evolutionary Instincts: Our ancestors had to act quickly to survive. Immediate action often meant the difference between life and death. Even in the modern world, action is often rewarded over inaction.

Imagine two team members: one who parrots (without any input) what their boss said while using buzzwords, and another who remains quiet. Who would be perceived as more knowledgeable?

🛠️ Desire for Control: We often prefer action because it gives us a sense of control. It feels like we can change things by doing something—anything. The desire for control fools people into mistaking action for progress.

Remember the Coca-Cola fiasco of the 80s? Pepsi's famous Pepsi Challenge had consumers doing blind taste tests and suggesting Pepsi is better, leading Coca-Cola executives to panic and change their classic formula.

This decision sparked massive backlash, a decline in sales, and even protests!

There was no concrete evidence that Pepsi tasted better when consumers weren’t blindfolded. Yet, the urge to act, to seem in control, led the executives to break something that was already working.3

😱 Fear of Regret: Fear of missing out or regretting inaction drives us to act. We worry that if we do nothing and things get worse, we’ll regret not intervening. This is incredibly common in the stock market, but more on that in a bit.

🏅 Immediate Gratification: Taking action often provides immediate relief from anxiety, whereas inaction requires patience and tolerance for uncertainty. We crave the reward.

😎 Mastering Action Bias: Turn It to Your Advantage

People like to stay busy—or at least feel like they are (is busy=happy?). And a surefire way to stay busy is to act.

However, sometimes inaction can be more productive. Charlie Munger said “sitting on your ass” investment style was his favourite.

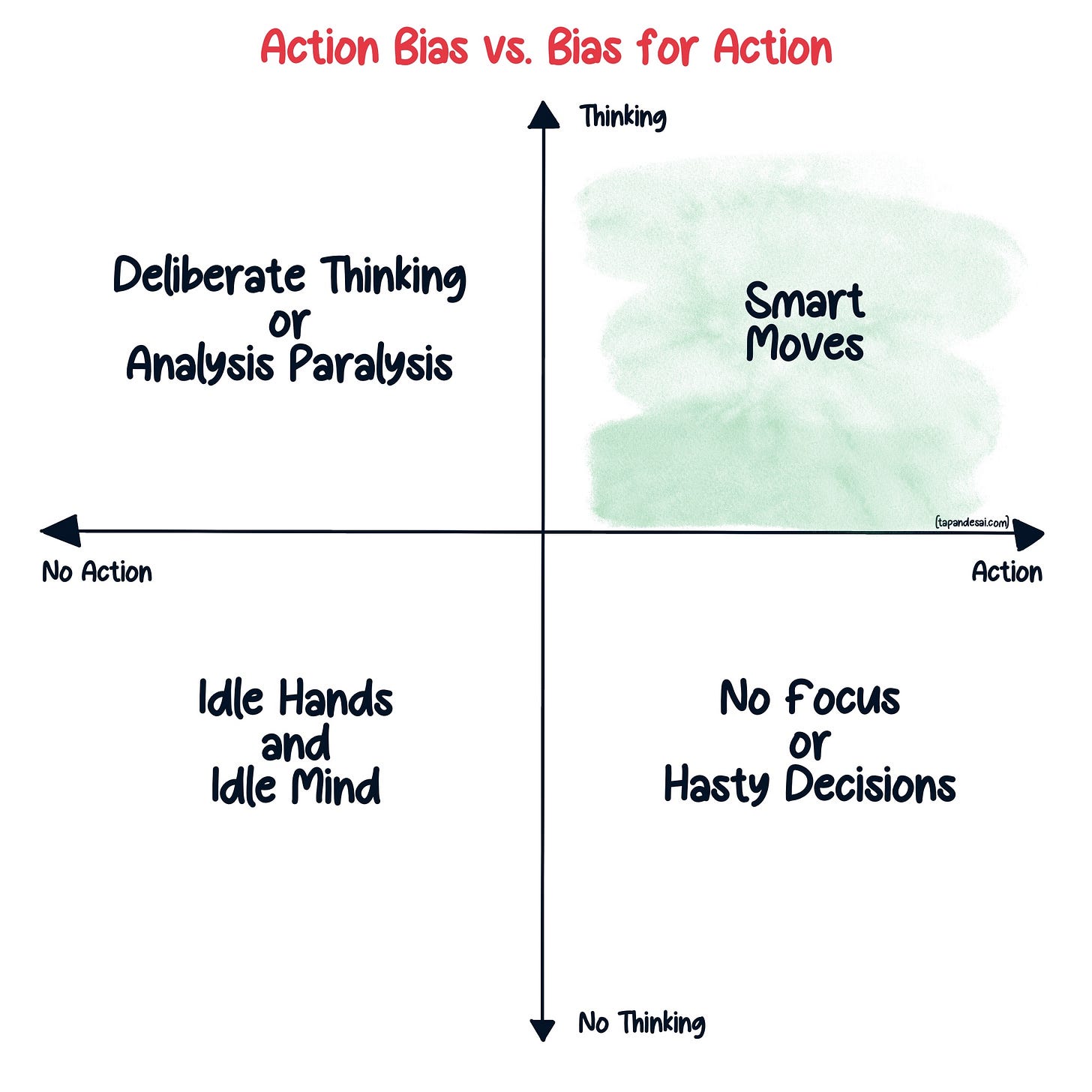

But as you can see below, thinking and action are a great fit.

So, sitting on your ass is an option and sometimes the best way forward, but only until you don’t have a way forward.

One effective question to ask yourself before acting is, “Will this action make the future easier or harder?” If you don’t have an answer, analyze more rather than falling victim to action bias.

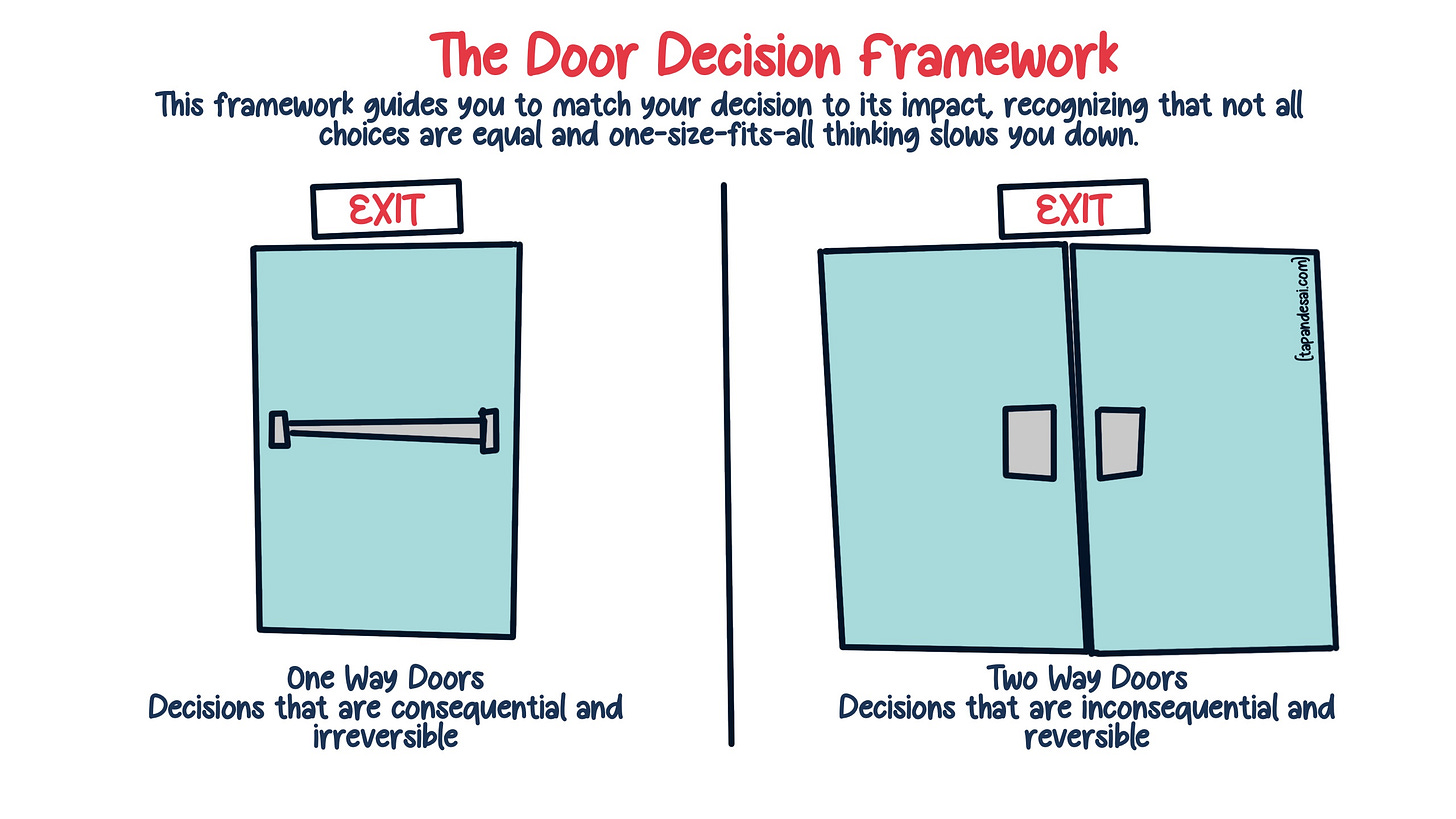

😵 Bias for Action vs. Action Bias

Action bias is when you act without thinking. Bias for action is when you think critically, make a decision, and act on it.

People often mistake decisiveness for quick decision-making and deliberation for indecision.

Part of what makes slowing down and reasoning through a problem difficult is that, to the outside observer, it might look like inaction. But inaction is a choice.

When the stakes are low, inaction hurts you more than speed.

Sometimes it’s better to make a quick choice and not spend time deliberating, especially for two-way door decisions.

When the stakes are higher, though, speed can hurt you (one-way doors).

🚢 Build the Damn Ark

Remember, action bias is taking action without a solid rationale.

But when you do have a strong rationale for action, remember Warren Buffett’s wisdom:

Predicting rain doesn’t count, building arks does.

💰 Action Bias in Investing: Patience Over Action

In the world of investing, action bias can be particularly detrimental.

Mohnish Pabrai, a renowned investor, often says he doesn’t want to hire anyone. Why? If he pays someone to make investment decisions, they will feel compelled to take action.

But investing is a game of patience. To be a successful investor, you need to be able to watch paint dry on a wall.

So, beware if you’re making investment decisions just because you have to. Remember what Uncle Warren has to say:

Nick Sleep, another seasoned investor, moved his Bloomberg terminal to a different room.4 Why? The constant stream of flashing results compelled him to take unnecessary action.

It’s like a dopamine hit, pushing for action when none is needed.

Rational investments shouldn’t be influenced by a fluctuating graph on a screen.

We don’t get paid for activity, just for being right. As to how long we’ll wait, we’ll wait indefinitely.

Warren Buffett

Until next time,

Tapan (Connect with me on Twitter or reply to this email)

Monthly Mulling💡

If you liked this issue, you will find my past issue on the Paradox of Choice interesting. Contrary to popular belief, having a plethora of options doesn't make us happier or more satisfied. In fact, it often does the opposite. Find out more.

Thank you for reading! 🙏🏽 Help me reach my goal of 3,000 readers in 2024 by sharing this post with friends, family, and colleagues! ♥️

Read this anecdote in William Green’s Richer, Wiser, Happier.