MONTHLY MULLING

Let's talk about investing, shall we?

Hi👋

Tapan here.

Monthly Mulling is a bi-monthly newsletter sending the best ideas from the web to your inbox for free. High signal. Low noise.

Happy Sunday y’all!

I want to share three ideas on investing, none of which are my own.

⏳ Patience

🤞🏽 Luck

😓 Risk

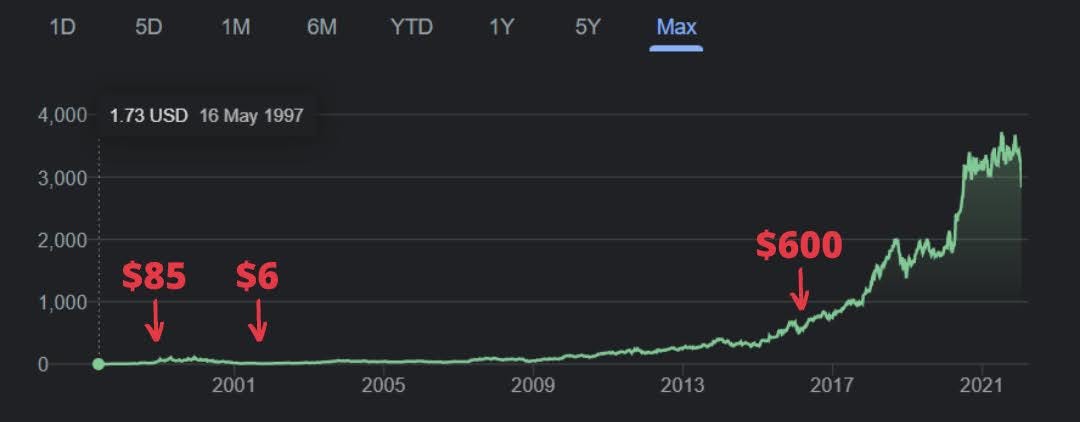

The markets are currently in the red and it’s important to take a step back and look at the long-term picture rather than focusing on the short-term. This image from Vishal (safalniveshak.com) brings my point home.

But first, this week:

📖What I am reading: Chatter: The Voice In Our Head & How To Harness It

🎧What I am listening to: Excuses by AP Dhillon (like every other Indian!)

Onwards🚀

💭MULLING

⏳ On Patience In Investing

One of the most important skills of a good investor is patience. I love this fishing analogy by Charlie Munger.

[In investing], you have to be like a man standing with a spear next to a stream. Most of the time he’s doing nothing. When a fat juicy salmon swims by, the man spears it. Then he goes back to doing nothing. It may be six months before the next salmon goes by (Tweet this)

If you invest, you can’t operate like a heat-seeking missile.

Once you’ve invested, shut up and wait. Never stop the compounding machine unnecessarily.

Ben Graham has given us this important lesson.

Be prepared and wait for a high-quality business at a reasonable price, stick with it over time till the business does well, then be humble to credit luck more than your skill for whatever success you achieve, and repeat this process if you get another fat pitch. Rest of the time, don’t act much. That will be your true skill.

Howard Marks in his recent memo shared an example of the Amazon stock👇🏽

Everyone wishes they’d bought Amazon at $5 on the first day of 1998, since it’s now up 660x at $3,304.

But who would have continued to hold when the stock hit $85 in 1999 – up 17x in less than two years?

Who among those who held on would have been able to avoid panicking in 2001, as the price fell 93%, to $6?

And who wouldn’t have sold by late 2015 when it hit $600 – up 100x from the 2001 low? Yet anyone who sold at $600 captured only the first 18% of the overall rise from that low.

On the flip side, there are also countless people who have ended up with duds in their portfolios when they realized their grandfather had bought some stocks and forgot about them for 15 years.

⭐ Buy good businesses and then, shut up and wait.

🤞🏽On Luck In Investing

Not enough people attribute luck to their investing success which is hilarious.

Even a turkey can fly in a tornado - when times are booming you can do dumb things with money, get sloppy, and take huge risks without even realizing it (Tweet this)

Let’s hear from Warren Buffett who is arguably the most successful investor on how luck is an important aspect of the market. Here’s an excerpt from the article Buffett wrote which I found in a Safal Niveshak newsletter.

Warren Buffett describes a contest in which each of the 225 million Americans starts with USD 1 and flips a coin once a day. The people who get it right on day one collect a dollar from those who were wrong and go on to flip again on day two, and so forth. Ten days later, 220,000 people have called it right ten times in a row and won US$ 1,000.

Buffett writes, “now this group will probably start getting a little puffed up about this, human nature being what it is. They may try to be modest, but at cocktail parties they will occasionally admit to attractive members of the opposite sex what their technique is, and what marvelous insights they bring to the field of flipping.”

After another ten days, there are 215 ‘survivors’ who have been right 20 times in a row and have each won US$ 1 million. By this exercise, each have turned one dollar into a little over $1 million.

…this group will really lose their heads. They will probably write books on “How I turned a Dollar into a Million in Twenty Days Working Thirty Seconds a Morning.” Worse yet, they’ll probably start jetting around the country attending seminars on efficient coin-flipping and tackling sceptical professors with, “If it can’t be done, why are there 215 of us?”

By then some business school professor will probably be rude enough to bring up the fact that if 225 million orangutans had engaged in a similar exercise, the results would be much the same — 215 egotistical orangutans with 20 straight winning flips.

This is a very important story and the reason I am reminding you of this today is because there are now more than 215 egotistical orangutans that are talking about how they have turned small amounts of money into millions investing in stocks and cryptocurrencies and how you can do that easily too.

Worse, each of these 215 have a following of more than 215,000, so you can understand the multiplier effect of the ‘how to get rich easily from stocks’ theory.

Even worse, they are not chest-thumping hanging on trees of some far off jungle, but in a computer or mobile screen right in front of you, on YouTube, Twitter, and everywhere.

As read in Safal Niveshak’s newsletter,

Skill in investing shines through over the long term, but a streak of being right in the short term can make anyone forget how important luck is in determining the outcome

⭐ Be modest when you get lucky. Don’t be fooled by randomness.

😓 On Risk In Investing

Don’t take risks that you don’t have to take.

Howard Marks explains what risk means very clearly.

Riskier investment means higher return is not true.

Riskier investments means a higher chance of higher return is true. Which also means, it means a higher chance of a loss.

Hence, it is risky!

If it directly meant that your return will for surely materialise, then it wouldn’t be risky.

Mohnish Pabrai encourages the low risk, high return approach. Heads I win, tail I don’t lose much.

Here’s my version of a Greenblatt quote.

Choosing individual stocks without understanding the business is like running through a dynamite factory with a burning match. You may live, but you’re still an idiot. (Tweet this)

I know so many people who have invested in businesses based on stock tips from friends or guru-investors on the TV.

Unless the fundamentals of the business have changed, if you liked the business at $682, you should love it at $397!

I am looking at you all the $NFLX holders.

⭐ The low price of a business should feel like a discount if you like the business, management, and long-term potential.

And that’s what these days in ‘red’ should feel like if you’re doing your due diligence before investing - A SALE!

📚 TREAT YO’ SHELVES

You can find my favourite books on my site and add me on GoodReads.

🌳 The Dark Forest by Liu Cixin

The second part of the Remembrance of Earth’s Past trilogy was better than the first book. I was literally at the edge of my seat as I was reading the end. And to be honest, I had to take a nap after reading it. It’s honestly troubling and filled with despair. I can’t wait to read the final book!

The past was like a handful of sand you thought you were squeezing tightly, but which had already run out through the cracks between your fingers. Memory was a river that had run dry long ago, leaving only scattered gravel in a lifeless riverbed. He had lived life always looking out for the next thing, and whenever he had gained, he had also lost, leaving him with little in the end.

💸 Modern Value Investing by Sven Carlin

This book can be skipped. There are better books out there that teach you the basics and the advanced stuff. Sven tries to piece together a lot of concepts in investing and gets nowhere.

Investing should be like watching paint dry or grass grow. If you want excitement, take $800 and go to Las Vegas - Paul Samuelsen

🎙PODCAST - COLD BREW MONEY

If you’re a listener, thank you so much!❤️ Can I ask you to share the podcast with one friend/family this weekend? It will really help us grow the podcast.

💰 #82 - Why Did We Invest $1000 In Facebook Metaverse ($FB)? | Facebook (Meta) Stock Analysis | Episode Page

💸 #81 - When To Sell A Stock? Lessons From Howard Marks | Episode Page

😷 #80 - Stock Analysis – Nexstar Media Group | Should we buy Nexstar Media? | Episode Page

Do you think any of your friends will like Monthly Mulling like you? Share it with them!😇

Thanks for reading. If you like Monthly Mulling, let me know. You can reach out to me on Instagram, Twitter, LinkedIn, or just reply to this email!