Monthly Mulling💡

What Buffett, Bezos and Aurelius Teach Us About Life & The Case of the Nodding Know-Nots

Hi👋 Tapan here.

Monthly Mulling is a 2x monthly newsletter with 3 timeless ideas to help you make better decisions in your life and career. Join now👇🏽

Note: If my emails end up in the ‘promotions’ tab, please move them to the inbox so you don’t miss out.

Happy Sunday y’all!

Before we start, as always, here are the updates:

✍🏼 New articles on the blog:

🕵🏼♂️ Sherlock’s Secret Sauce: Balancing Focused and Diffuse Thinking for Innovative Solutions

📈 The Mystery of the Matthew Effect: Why Do The Rich Get Richer?

📖 Currently, I am reading: From Third World to First: The Singapore Story by Lee Kuan Yew (LKY)

Charlie Munger has called LKY as one of the greatest nation-builders. The story of Singapore always intrigued me. How did a small island nation and former British colony without any natural resources become a first-world country within 3 decades of gaining independence? LKY is accredited for this achievement.

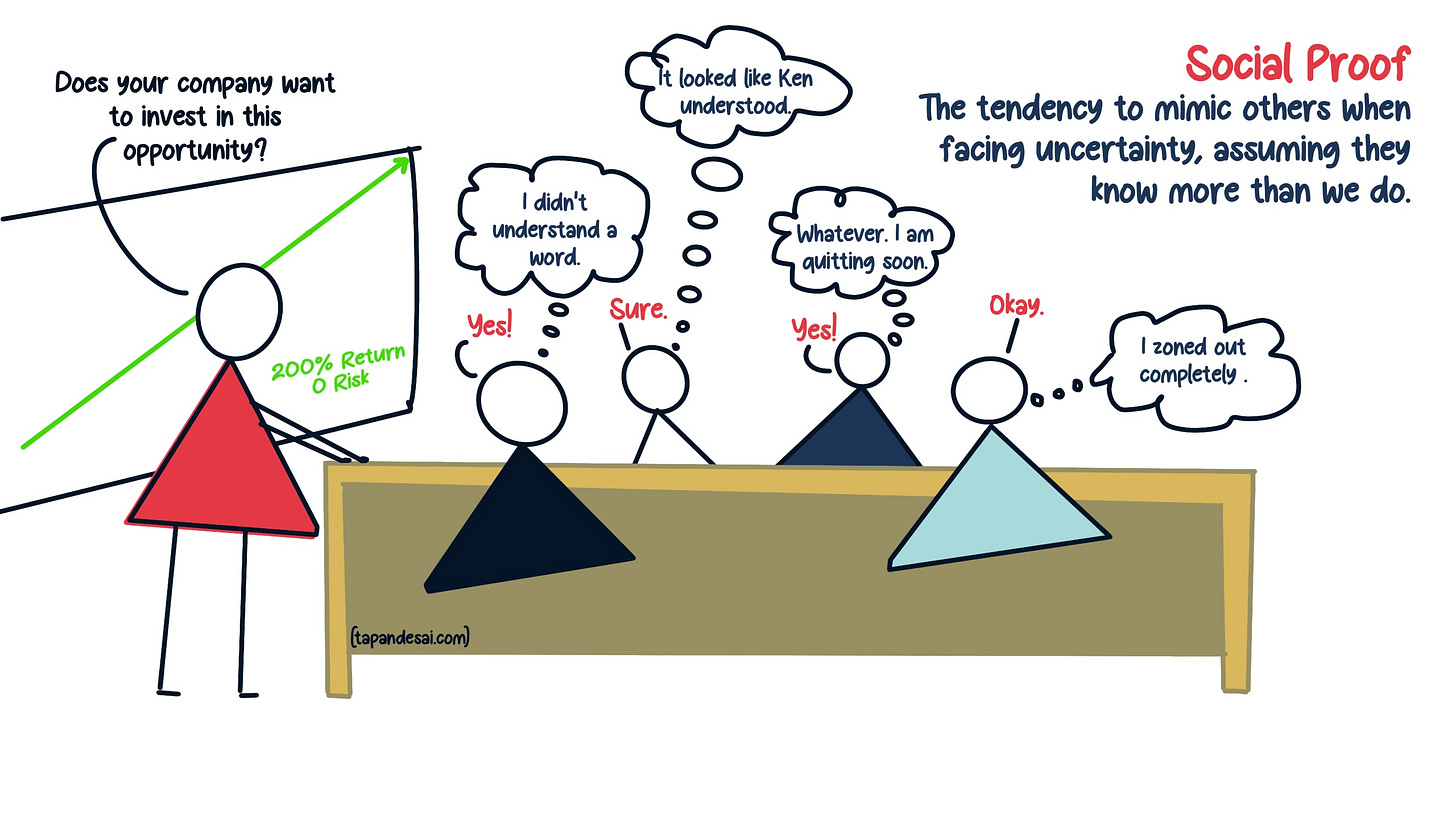

🪞 The Power of Imitation: The Traps of Social Proof

Jake in his company attended a meeting where an investment proposal was presented that promised a 200% return📈.

Jake found himself in a mental twist as he attempted to untangle the convoluted proposal. The acronyms in the investment proposal might as well have been ancient hieroglyphics. He glanced around, searching for a lifeline among his 11 colleagues who, as if choreographed, were all nodding their heads.

Jake thought, “Aaah great. They all understand!”

And then came the question, “Does your company want to invest in this opportunity?”.

There was a brief silence and then Jake’s colleague, Kenneth, said “Sure!”.

Suddenly, all the remaining 11 team members were nodding in agreement. The business invested in the opportunity.

A year later they collectively had lost about $30 Million 🤦🏽♂️. How could 12 smart individuals in a top company be fooled?

It turned out no one had actually understood the proposal. Not even Kenneth. Damn it, Ken!🤬

Each individual automatically assumed that the other 11 individuals present at the meeting had evaluated the investment proposal. If there was something bad, someone else would have said so.

When people are free to do as they please, they usually imitate each other.

— Eric Hoffer

🧠 Why did this happen? Social Proof. We often lean on the judgments of others when faced with uncertainty, stemming from the assumption that they possess more knowledge about the situation. But this herd mentality, while comforting, can lead us into dangerous territory.

But why do we do it?🫡

We are social animals, influenced by what we see other people doing and believing. We believe that others know more than we do. We also want to avoid embarrassment when we're among strangers (or colleagues).

We feel more comfortable as part of a majority. It acts as a protection from criticism. If we are wrong and everybody else is too, we get less blame.

Where all think alike, no one thinks very much.

— Walter Lippmann

This is all great but what are some real-life examples of social proof? 🤔

💼 Business and Meetings: We've already witnessed Jake's ordeal (Ken, you're still on our blacklist!). In team meetings where quick decisions are necessary, the phenomenon of social proof can emerge, leading to a group consensus that might result in suboptimal or even outright incorrect conclusions. This is also referred to as 'groupthink'.

🥸 Public Events and Gatherings: Crowds have a tendency to behave irrationally. An influential leader, for better or worse, can leverage social proof to steer their agenda. As a rule, group decisions usually reflect the inclinations of individuals, but in a more pronounced manner. This phenomenon, known as the Group Polarization Effect, means that leaders can disseminate extreme views.

😵💫 Social Events, Media, and Marketing: The prevalence of social proof is evident in numerous social contexts. For instance, a long queue outside a club sends a message of popularity to bystanders. A restaurant boasting a perfect online rating gives the impression of quality cuisine. An online product endorsed by a celebrity influencer with a vast following serves as a signal that the product is worth buying.

💰 Investing: Social proof also makes its appearance in the investment world. Investors often mimic the buying or selling decisions of successful 'super-investors', presuming their choices are well-researched. Mohnish Pabrai refers to this as 'cloning', but such a strategy can lead to losses if due diligence isn't undertaken.

Even though all of these can be biased, anecdotal or even fake, we judge people ‘like us’ as more trustworthy.

The five most dangerous words in business are: ‘Everybody else is doing it.’

— Warren Buffett

So, what can you do?💡

✋🏽 Consider: What is popular is not always right. If you don't like what other people are doing, don't do it.

🤔 Evaluate: Ask - Does this make sense? Disregard what others are doing and think for yourself.

😎 Act: If you have formed a conclusion from the facts and if you know your judgment is sound, act on it - even though others may hesitate or differ.

🗳️ Create Safe Spaces: Encourage confidential voting in group decisions to minimize social pressure.

If 40 million people say a foolish thing, it does not become a wise one.

—Somerset Maugham

🥸 The 10 Commandments For A Narrow-Minded Life

If you’re looking for a life devoid of learning, growth, and personal development follow these 10 commandments and you will become intolerant in no time:

Defend Your Ego at All Costs

Abandon Intellectual Pursuits

Revel in Sensationalism

Build Your Personal Echo Chamber

Selectively Gather Evidence

Assert Dominance in Conversations

Embrace Binary Thinking

Bask in Self-Assuredness

Exude Unfounded Confidence

Stay Secure in Your Comfort Zone

🧠 But if you've somehow found yourself seeking a life of growth and wisdom instead, here's the golden rule:

Invert, always invert.

— Charlie Munger

This is an excerpt from my article on inversion. If you don’t know what’s inversion, you can read the full article here👇🏽

🫡 Standing on the Shoulders of Giant: Wisdom from Buffett, Bezos, and Aurelius

What's common between Warren Buffett, Jeff Bezos, and Marcus Aurelius? A deep understanding of life and a knack for imparting that wisdom.

Warren Buffett’s shareholder letters and the Berkshire Hathaway Annual General Meetings (AGM) hold a wealth of wisdom.

In a recent AGM, an investor asked Buffett, “How do you avoid mistakes in life?”

🧠 Buffett answered, “You should write your obituary and figure out how to live up to it.”

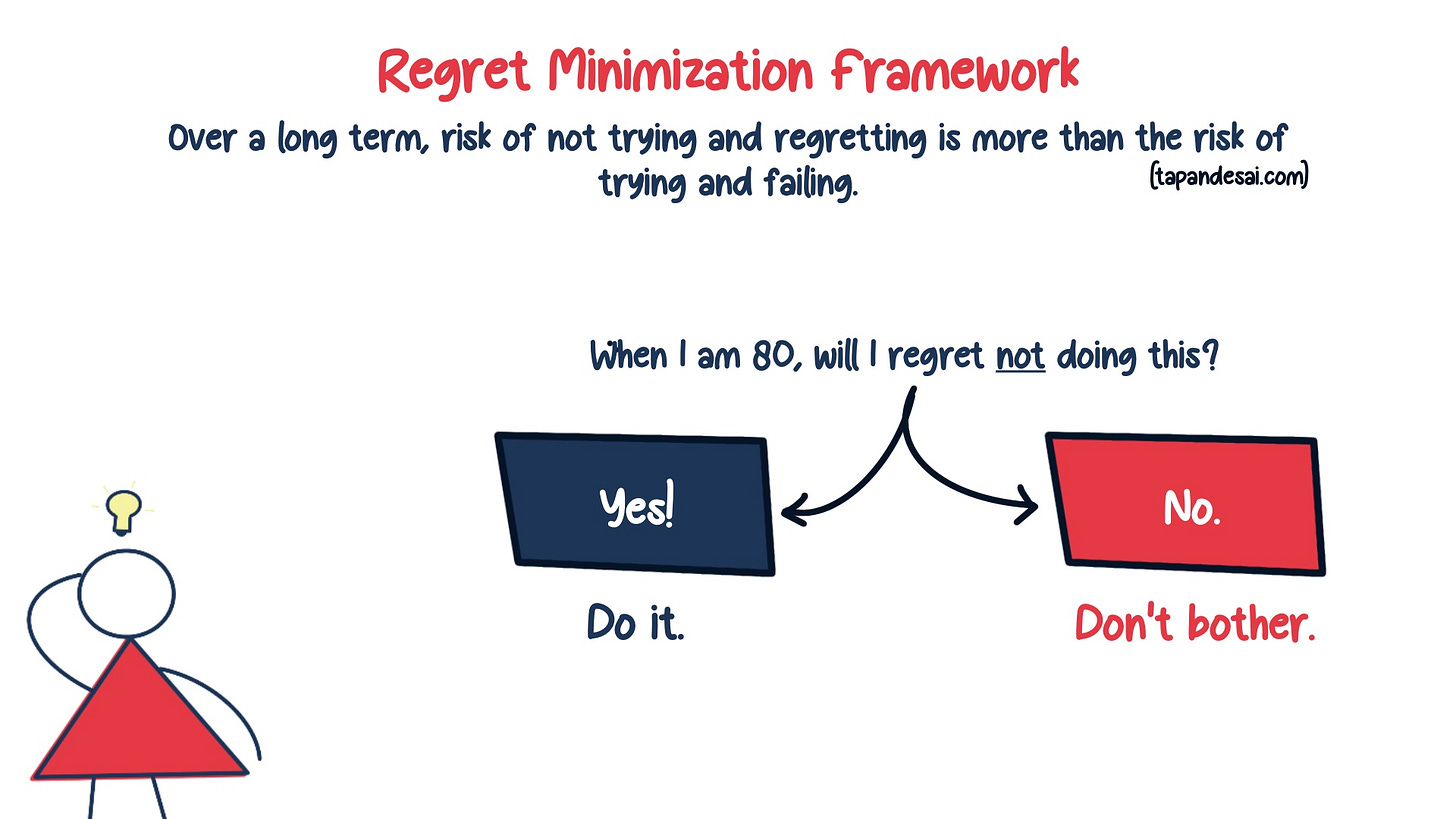

The idea is that you should imagine the end of your life and work backwards from there. Jeff Bezos has a similar framework called Regret Minimization Framework (read my full article here).

You project yourself forward to age 80 and say, “Okay, now I’m looking back on my life. I want to minimize the number of regrets I have.”

Now, being a student of Stoicism and having read Marcus Aurelius, this sounds familiar to the 2000-year-old stoic concept of memento mori.

Memento mori is a Latin phrase meaning ‘remember you must die’. It is a reminder of the inevitability of death. If you remember this, you will live very differently 😌.

If we kept in mind that we will soon inevitably die, our lives would be completely different. If a person knows that he will die in a half hour, he certainly will not bother doing trivial, stupid, or, especially, bad things during this half hour.

— Leo Tolstoy

You can read my full article on stoic decision-making here.

Thanks for reading 🙏🏽 Do you think any of your friends or family will like Monthly Mulling like you? Please share!😇

If you have any comments, you can connect with me on Twitter or reply to this email!