Hi👋 Tapan here.

Monthly Mulling is a bi-monthly newsletter curating the best ideas from the web to your inbox for free. High signal. Low noise. Join now👇🏽

Note: If my emails end up in the ‘promotions’ tab, please move them to the inbox so you don’t miss out.

I wish you and your loved ones a happy Diwali and a blessed year ahead! 🪔

Diwali is a time of major FOMO for me. I have been away from home for about 8 years but miss the family a little extra during Diwali!🥺

I don’t think I am ever going to shake that feeling off but if you’re celebrating Diwali with your loved ones this weekend, here’s a reminder to hug them a tad bit longer!🤍

Currently,

📖 What I am reading: The Billionaire Raj by James Crabtree

The book talks about India’s politicians and crony capitalists who work together to compound their own wealth at the expense of the poor. The income divide is only increasing in India. It has been a good follow-up read to Bulls, Bears, and Other Beasts and The Unusual Billionaires.

📺 What I am watching: House of the Dragon (HBO) and Shantaram (Apple TV)

Onwards 🚀

🤔 Does BUSY = HAPPY?

“I am really busy” is a common response I have heard from friends, family, and colleagues. Hell, I have used it about a million times!

So why is everyone so busy?

One answer is that people like to be busy or at least think they are busy. A lot of people dread idleness and are generally happier when they’re busy than when there’s nothing to do.

In this article, Scott talks about 3 theories for our collective busyness.

😎 Busyness as signalling: Busy people are important. Complaints about busyness are like complaints about paying too much in taxes—something that allows you to subtly communicate your status.

🫠 Busyness as dodging commitment: Claiming busyness is a socially acceptable way to decline social obligations. “I wish I could, but I’m too busy”.

🫥 Busyness as self-deception: You are making tasks up that are really not a priority so that you don’t have to work on tasks that will actually move your life forward.

Based on the three theories, you might gather busy is not always equal to being happy. You’re pretending to be busy which might not lead to happiness.

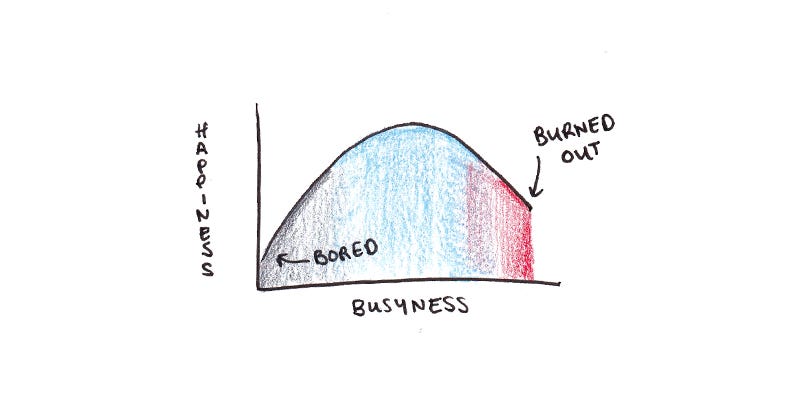

So how busy should you be to be happy? You have to find the sweet spot. Not so busy that you’re overwhelmed but enough so you’re not bored.

The sweet spot might differ from person-to-person. Some people are happier when they are less busy and so on.

But it’s also important that you’re busy doing the right thing and not just deceiving yourself.

So, busyness can lead to happiness if you find the sweet spot and also,

You’re busy working on something that excites you

You’re busy doing something that is a priority in your life

You’re doing the above two to your desired standard

💰 Investing Advise Which Is Not Sexy

I recently finished reading Bulls, Bears, and Other Beasts which is a fictional account of real-life events in the Indian stock market from 1988 - 2015.

The book ends with some sound financial advice from the main character of the book, Lala, which I wanted to share 🤓

It’s a letter to the audience. I am sharing my favourite bits and with the current market condition, it might be relevant to those of you who invest.

The amount of risk you are willing to take will decide the level of returns you make. But you need to see this in the context of another stock market truism: only risk what you can afford to lose.

Big risks do not always guarantee big returns; you can lose big too.

Know what you are getting into and why you are doing so.

Gracefully accept your losses. Consider it as some kind of a tuition fee that the market demands from every player.

Everybody in the market makes mistakes; even the best of investors don’t have a track record of 100% wins, despite their knowledge of the field.

If you are convinced that a certain stock is a good long-term investment, don’t shy away from buying it even if the price moves up 20% from the time you first identified the stock. It is much costlier not to have bought that stock at all.

‘Trees don’t grow all the way to heaven and roots don’t grow all the way to hell.’

There is no harm in booking profits occasionally and spending that money well.

And finally, don’t lose heart if you did not make as much money as you would have liked to in the bull market.

The important thing is to preserve capital and wait patiently for the right opportunities, rest assured that there will be many in the years ahead.

As Uncle Warren says, wait for the perfect pitch.

⚓️ How Did India Fall to the Europeans?

India was an industrial powerhouse before the establishment of the British Empire. So, what changed in the 1700s that led to India’s fall to the Europeans?

This is a quick short video on the history. But a word of caution. History is complex and it’s very difficult to capture all aspects and parameters of the colonisation in a 15-minute video!

Do you think any of your friends will like Monthly Mulling like you? Please share!😇

Thanks for reading. If you have any comments, you can connect with me on Instagram, Twitter, LinkedIn, or simply reply to this email!