Hi👋 Tapan here.

Monthly Mulling is a bi-monthly newsletter sending the best ideas from the web to your inbox for free. High signal. Low noise. Join now👇🏽

Happy Sunday y’all!

🌇 Summer is almost here which means longer days, sunset walks, and, of course, drinks by the river!

📖 What I am reading:

Boom & Bust: A Financial History of Global Bubbles (history doesn’t repeat itself but it often rhymes! Topical, eh?😂)

Reflections: Swami Vivekananda (tough read, hopefully, I get through!)

📺 What I am watching:

Mark Rober destroying scam callers in India! (Love this guy!)

Doctor Strange in the Multiverse of Madness (a lot happening but it’s fun! If you’re a sucker for everything Marvel like me, definitely a watch)

Onwards🚀

💭MULLING

🧠 Confirmation Bias

I want to talk about this bias because of my current Twitter feed. It’s filled with polar opposite views of strongly held beliefs. I guess I have done a good job of curating my feed?😂

🤦🏽♂️WHAT?

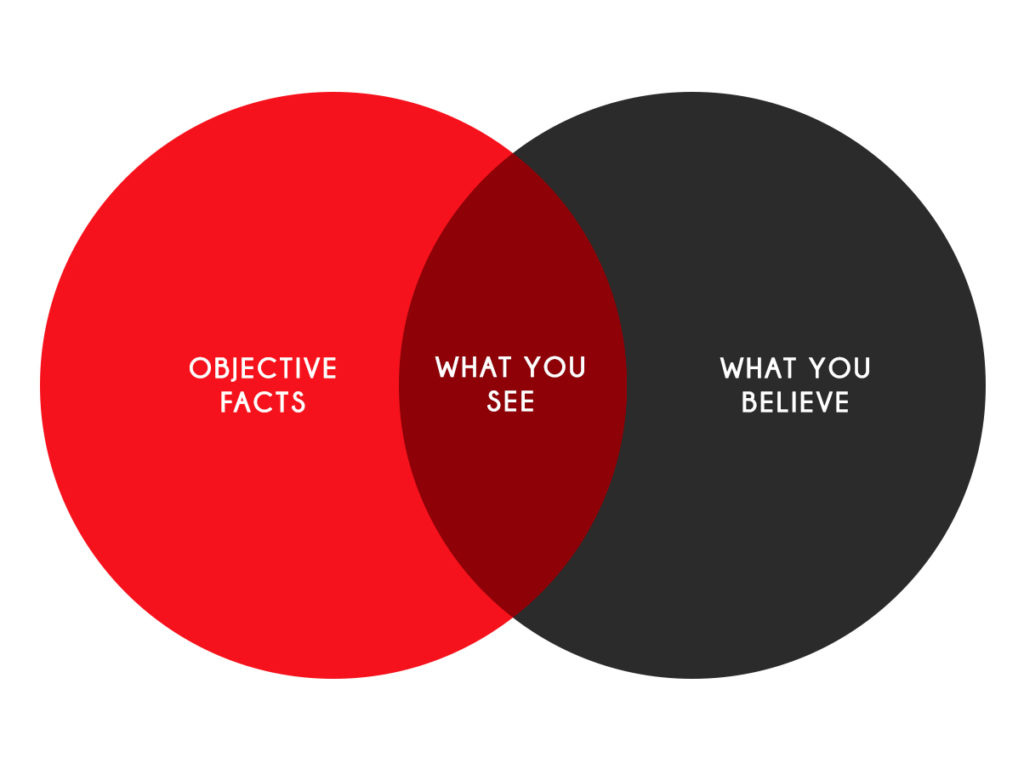

Confirmation Bias says that humans have a tendency to see and interpret information in a manner that supports previously held beliefs.

We systematically ignore evidence that negates our beliefs and embrace evidence that confirms them.

👀 As a result, we fail to see the world as it is and instead see it how we want to see it.

We can see this in politics, news, investment strategies, and daily work life! Ever had a colleague who is hell-bent on doing something their way and not listening to the other side of the argument?🤦🏽♂️

The reluctance to reexamine our views and change our minds is one of the greatest impediments to rational thinking. Instead of keeping an open mind, we tend consciously and unconsciously prioritize information that reinforces what we believe.

Charlie Munger

The social algo Gods are not helping with this bias either. You are constantly served with what you want to see, what you already believe in. The filter bubble 💭

The most difficult subjects can be explained to the most slow-witted man if he has not formed any idea of them already; but the simplest thing cannot be made clear to the most intelligent man if he is firmly persuaded that he knows already, without a shadow of a doubt, what is laid before him

Leo Tolstoy

💭 HOW?

So, let’s see what we can do about it.

🤔 Critical thinking: form a bear case for any belief that you hold. Ask

Why am I wrong?

What’s the exact opposite of my belief and why does it make sense?

🔎 Search for competing ideas: confuse the f out of the search algorithms. Search for competing ideas from a diverse range of sources.

Seek for disconfirming evidence to avoid stupidity.

🦉 University of Berkshire Hathaway (Book)

Warren Buffett and Charlie Munger have been long-time mentors (Eklavya-style).

If you have heard them speak or read their letters, you will understand they teach more than investing. They teach you how to live😇

Every year, Berkshire Hathaway holds their Annual General Meeting in Omaha where ~40,000 investors herd in to listen to two old dudes (combined age of 190 years!😲) rant about life and money. It’s called the Coachella for Capitalists!

The 2022 AGM took place about a couple of weeks ago and we even made a video👇🏽

The University of Berkshire Hathaway is a collection of notes from these AGMs for over the past 30 years.

Here are the 10 lessons from Warren and Charlie that I took from the book ✍🏽

🤝🏽 It is helpful to list the qualities you would want in a friend and then seek to instil those qualities in yourself.

🤦🏽♂️ If you disagree with someone, you should understand their side better than they do before you open your mouth. [This one is my favourite⭐]

😅 It’s a good habit to trumpet your failures and be quiet about your successes.

🧠 Fill your mind with competing ideas, and see what makes sense to you. [Confirmation bias, we have read that above!]

😇 Be with a person with an IQ of 130 who thinks it is 128 than a person with an IQ of 190 who thinks it is 240. The latter will get you into a lot of trouble! [Dunning-Kruger Effect]

📚 It helps to have a passionate interest in knowing why things are happening. Cast the mind over a long time to improve its ability to cope with reality. Those that don’t ask why are destined for failure, even those with very high IQs.

😱 Fear and Greed are two super-contagious diseases that will forever occur in the investment community. The timing and market conditions of these epidemics will be unpredictable, both in duration and impact. Therefore, they never try to anticipate the arrival or departure of either disease! We’re predicting how people will swim against the current. We’re not predicting the current itself.

🔮 The failure rate of all great civilizations is 100%. [Changing World by Ray Dalio - watch!]

💼 The Ideal Business for them is something that costs a penny, sells for a dollar, and is habit-forming.

🏰 The ideal business also has a wide and long-lasting moat around a terrific castle with an honest lord. The moat represents a barrier to competition and could be low production costs, a trademark, or an advantage of scale or technology.

⭐Summary of all investing lessons

Spend less than what you make. Know and stay within your circle of competence. The only businesses that matter are the ones you put your money in. Keep learning over time. Don’t lose. Insist on a margin of safety.

Our CBM TOOLBOX 🧰 is based on a lot of these principles. It helps you make investing decisions👇🏽

📸How Postwar Italy Created The Paparazzi (Video: 7 mins)

The fascinating story behind the term “paparazzi”. The story involves Mussolini (yes, the Dictator), a film studio, and Italian law for earnings in the country! 🤯

🎙PODCAST - COLD BREW MONEY

If you’re a listener, thank you so much!❤️

Can I ask you to share the podcast with one friend/family this weekend?

📉 Stock Market Crash: The market is not doing so well. Our portfolio is down 30%. When we started CBM one of our key tenets was to be transparent about our failures and the portfolio update is part of that tenet. We don’t want to only share our success stories! You can also track our portfolio against the S&P here.

👌🏽 3 Stocks Better Than Alibaba: Alibaba is a great long-term business and a lot of investors added $BABA to their portfolios in 2021. But with the recent market pullback, there are a lot better opportunities.

Do you think any of your friends will like Monthly Mulling like you? Share it with them!😇

Thanks for reading. If you like Monthly Mulling, let me know. You can reach out to me on Instagram, Twitter, LinkedIn, or just reply to this email!