MONTHLY MULLING 💡

Mental Models For Better Decision-Making, Zeigarnik Effect, and Why Do We Buy Expensive Products Over Cheaper Products?

Hi👋,

Tapan here.

Monthly Mulling is a newsletter sending the best ideas from the web to your inbox for free. High signal. Low noise.

If you were forwarded this email, you can subscribe here and join a community of 180+ readers.

Happy Sunday y’all!

I wanted to share a cheeky tip to wake up early that I have been using for the past 8-months. On most days, I am up before my alarm goes off (show off!) but on the select few days when I can’t just get out of my bed, I use this.

Yep, it works like a charm. Counter-intuitive. People say don’t touch your phone when you wake up. But if you use it only for 5-minutes when you wake up, scroll through your social media feed - you will definitely see your sleep fade away.

Onwards🚀

💭MULLING

📝 ZEIGARNIK EFFECT (2 minutes)

Open tasks tend to occupy our short-term memory–until they are done. This is Zeigarnik Effect. That is why we get by thoughts of unfinished tasks, regardless of their importance. Unfinished work continues to exert an influence, even when we try to move on to other things.

Bluma Zeigarnik observed the effect while sitting in a busy restaurant in Vienna. She noted that the waiters had better memories of unpaid orders. Once the bill was paid, however, the waiters had difficulty remembering the exact details of the orders.

Soap operas and serialized dramas also take advantage of this effect. The episode may end, but the story is unfinished. Cliffhangers leave viewers eager to learn more, and thanks to the Zeigarnik effect, they will remember to tune in next time to find out what happens. Netflix should write a book on human biases they exploit to keep us on their platform.

I read about this in Sonke Ahrens’, How To Take Smart Notes. It’s a must-read for anyone interested in creating a second brain using Zettelkasten. I talk about note-taking and Zettelkasten in my article linked below. Give it a read.

How to deal with it?

If you’re leaving something unfinished, note it down. It gives some comfort of accomplishment.

Break up big tasks, instead of taking on everything at the same time.

Writing - if you want to leave the writing mid-way, leave a summary of thoughts which can act as a starting point when you start again.

🧠 MY FAVORITE MENTAL MODELS (Article - 15 minutes)

My birthday is fast approaching and I wanted to revisit an article I wrote last year. I wrote about principles that have changed my life. It’s a list of mental models, biases, and frameworks that I use to make decisions.

Today, I wanted to reflect on 3 principles that I use the most.

Survivorship Bias: is the logical error of concentrating on the people or things that made it past some selection process and overlooking those that did not, typically because of their lack of visibility. If 10 people made it to the top, don’t just chase their success. Look at the people who didn’t as well. What was the difference?

The Aggregate of Marginal Gains: tiny habits while small in isolation produce enormous changes when combined. Small habits don’t add up, they compound. Reading daily will compound over time rather than not reading at all.

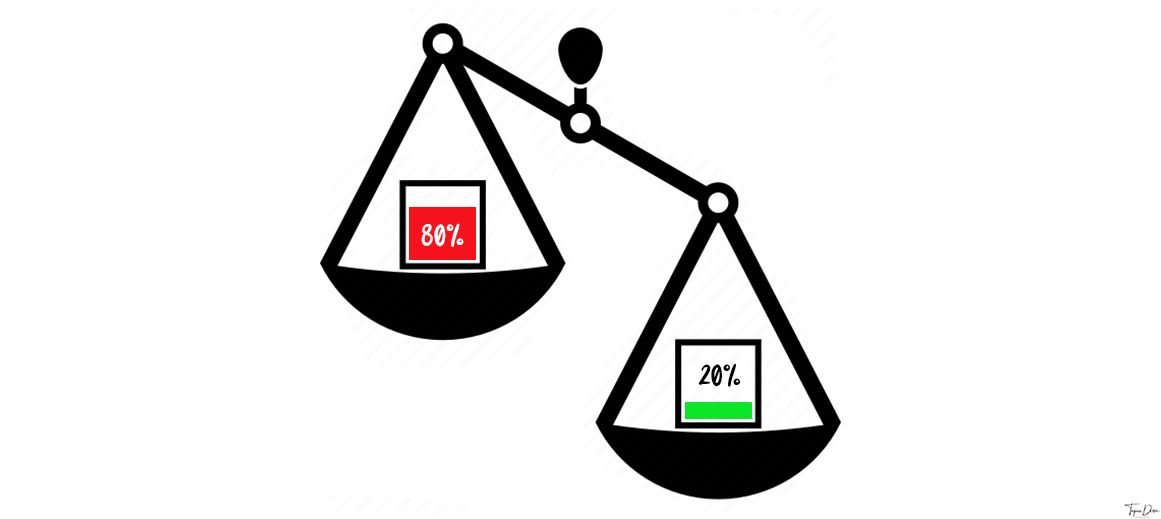

Pareto Principle: 80% of the effect comes from 20% of the causes. 20% of input causes 80% of the output. 80% of the impact is from 20% of the action. Go for the 20% which causes the most impact. Are you hunting antelopes or field mice?

What are your favorite frameworks that you use regularly? Comment below.

🙈 WHY DO WE CHOOSE EXPENSIVE PRODUCTS? (3 minutes)

The answer is Judgemental Heuristics. We can’t be expected to recognize and analyze all the aspects of each person, event, and situation we encounter in one day.

We haven’t the time, energy, or capacity for it. Instead, we must often use our stereotypes, our rules of thumb, to classify things according to a few key features and then respond without thinking when one or another of the trigger features is present.

I read about Judgemental Heuristics in a book called Influence by Robert Cialdini. It’s one of the click, run behaviors humans have developed over time.

Imagine you are in a foreign nation, shopping for a local product. Which product will you choose to gift your friend? Most humans will go for the expensive product. Sure, we will bargain. But without having a baseline price set or knowing about the country, most of us will think, “I am gifting this to my friend. If it is expensive, the quality will be good”.

Judgemental Heuristics are shortcuts and operate in much the same fashion as the expensive = good rule, allowing for simplified thinking that works well most of the time but leaves us open to occasional, costly mistakes.

📚TREAT YO’ SHELVES

You can find my favorite books on my site and add me on GoodReads.

💰 The Dhandho Investor by Mohnish Pabrai

About the book: Mohnish takes lessons from Patel’s running motel business in the US and explains how can you apply them to build your investment philosophy. It’s a great book for people wanting to learn about value investing. You don’t purchase stocks, you buy businesses. I talked about this in my previous newsletter and wrote about it on my blog.

Important Lesson:

Buy existing businesses which are simple and inside your circle of competence. Wait patiently for the big salmon to swim by, when it does, strike. And strike hard. Place big bets, infrequent bets. Only place bets when you have an advantage. You should get a dollar’s worth of assets for less than a dollar. And never forget – heads, I win; tails, I don’t lose much!

Favorite Quotes:

Our life is frittered away by detail ... simplify, simplify - Henry Thoreau

The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple - Charlie Munger

Always take advantage of a situation where Wall Street gets confused between risk and uncertainty - Mohnish Pabrai

📈 Rule #1 by Phil Town

About the book: Hands down one of the best investment books I have read. It doesn’t only teach you the basics but lays out how to actually value an asset before purchase. A must-read for beginners who are interested in investing. It’s like Atomic Habits but for wealth creation.

Important Lessons:

Focus on the 4 Ms before investing - meaning, moat, management, and margin of safety.

Don’t buy a company that you are not passionate about, a business/product you don’t use, or a business/product you don’t spend money on.

The price of a thing is not always equal to its value.

Favorite Quotes:

The 10-10 Rule: I won’t own this business for ten minutes unless I’m willing to own it for ten years - Phil Town

That which we persist in doing becomes easier, not that the task itself has become easier, but that our ability to perform it has improved - Ralph Waldo Emerson

Buy when others are fearful and sell when others are greedy - Warren Buffett

😢 When Breath Becomes Air by Paul Kalanithi

About the book: I won’t lie. This is the first book that had me in tears. I finished the book in two sittings. The memoir reflects on what makes life meaningful through the lens of Paul, who was a neurosurgeon and neuroscientist diagnosed with cancer.

Important Lesson:

I would recommend reading this book to actually feel it, learn from it. Unless you read the book, you won’t be able to step in Paul’s shoes and think about death, the way he introspected it. The book, in all honesty, is more about being alive than dying.

Favorite Quotes:

We are never so wise as when we live in this moment.

Years ago, it had occurred to me that Darwin and Nietzsche agreed on one thing: the defining characteristic of the organism is striving.

Most ambitions are either achieved or abandoned; either way, they belong to the past. The future, instead of the ladder toward the goals of life, flattens out into a perpetual present. Money, status, all the vanities the preacher of Ecclesiastes described hold so little interest: a chasing after wind, indeed.

🎙PODCASTS

💰 COLD BREW MONEY

If you’re a listener, thank you so much! Can I ask you to share the podcast with one friend/family this weekend? It will really help us grow the podcast.

We are now on YouTube too (if that’s your thing)! You can subscribe here.

💰 #59 – The Dhandho Framework By Mohnish Pabrai: we go through Pabrai’s Dhandho Framework | Episode Page

👨🏼🏫 #60 – What Are The Superinvestors Buying In Q2 2021? (U.S.A & India): we check superinvestor portfolio’s for Q2 2021 | Episode Page

See ya. Do you think any of your friends will like Monthly Mulling like you? Share it with them!😇

If you like Monthly Mulling, let me know! You can reach out to me on Instagram, Twitter, LinkedIn, or just reply to this email!