Hi👋 Tapan here.

Monthly Mulling is a bi-monthly newsletter sending the best ideas from the web to your inbox for free. High signal. Low noise. Join now👇🏽

Happy Sunday y’all!

📚 I recently finished reading The Curious Incident of the Dog in the Night-time. I don’t read fiction often but I was fascinated with this one! It’s written from a child’s perspective who is diagnosed with Aspergers and attempting to solve a murder mystery of a dog🔪

👨🏽🏫 Apart from knowing the basics of Aspergers, I have been ignorant of the problems a person might face who is diagnosed with it until I read this. This book is one of those which you finish in one sitting.

Currently,

📖 What I am reading: A Little History of Religion (as the name suggests, it’s a quick history of all world religions and the story behind their formation)

📺 What I am watching: The World’s Biggest Wave, Explained (This is another Vox masterpiece. I have never surfed🏄🏽♂️ but I always found Nazaré interesting. So much so, that I included it in my CBM Bio!)

Onwards🚀

💭MULLING

🚩 The Financial Bubble Triangle

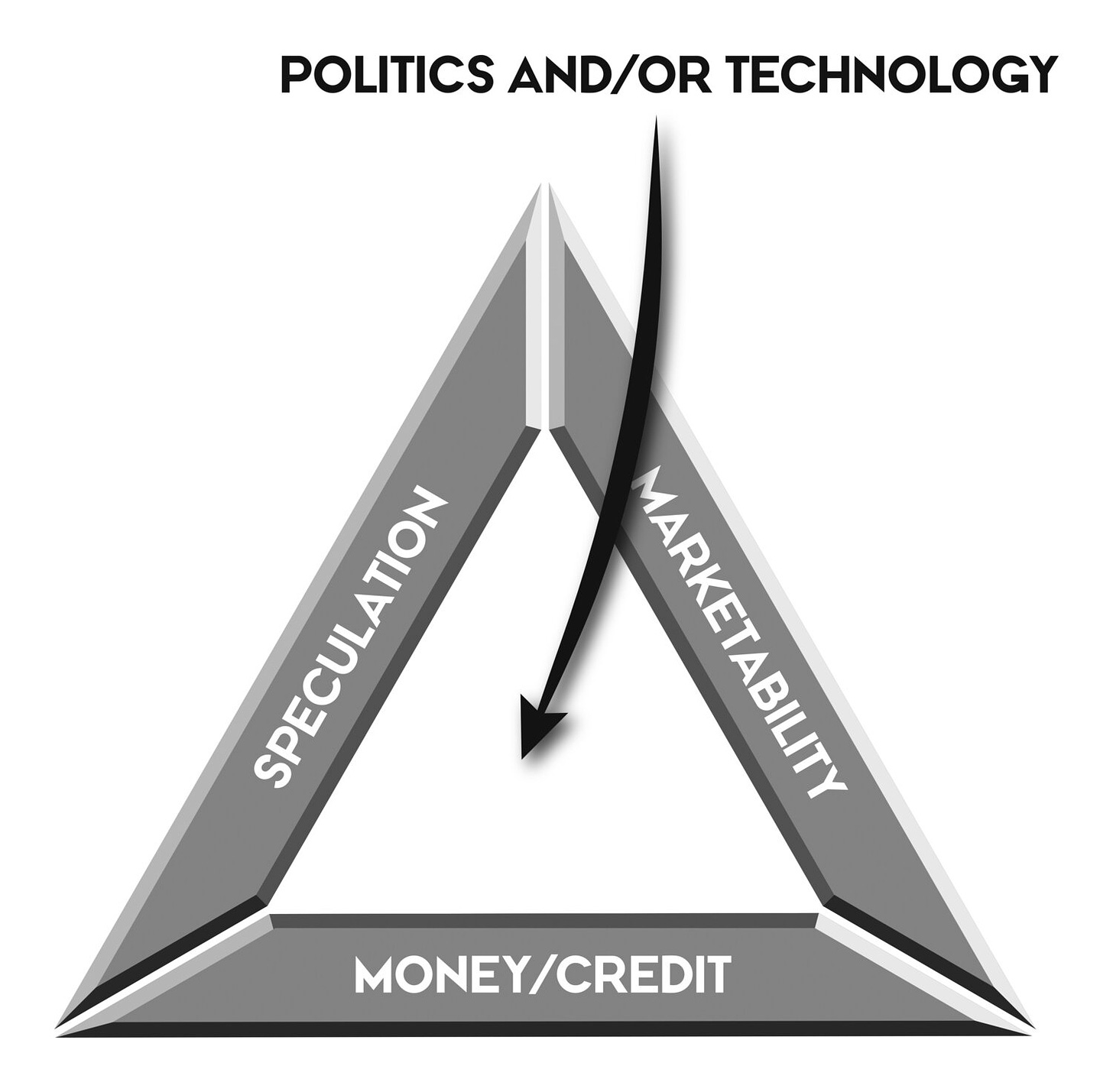

During my read of Boom & Bust, I came across the idea of the Bubble Triangle. It’s a great way to understand how financial bubbles are created!

🔥We need to view financial bubbles as the fire: destructive, self-perpetuating, and difficult to control.

The fire triangle consists of oxygen, fuel, and heat. And given sufficient levels of these three components, a fire can be started by a simple spark. You need to remove one of the components to extinguish the fire.

Similarly, a financial bubble has three components:

🤩 Marketability (or oxygen): It’s the ease with which an asset can be freely bought and sold including the divisibility and transferability of the asset. If we look at the current market, think about fractional shares or cryptocurrency. You can easily buy them in small quantities.

💵 Money and credit (or fuel): A bubble can form only when the mass public has sufficient capital to invest in the asset. In the current market, think about low-interest rates and loose credit (and maybe, stimulus checks during the pandemic 🤔)

👀 Speculation (or heat): It’s the buying and selling of assets with the sole motivation of generating a capital gain. Speculation is always present. However, the number of speculators increases tremendously during a bubble with a majority of them having FOMO🤑

🎇Now, we just need a spark to light the fire. This comes from government intervention (lower interest rate, increasing money supply, financial deregulation) or technology innovation (internet boom, cryptocurrency, or credit default swaps).

💭 So, how do bubbles burst? They run out of fuel or change in oxygen levels. Money runs dry and people start selling OR a policy/technology change makes the marketability different.

The four most dangerous words in investing are “this time it’s different”. At stock market tops and bottoms, investors invariably use this rationale to justify their emotion-driven decisions.

⚠️ Project Plan Errors (Article: 5 mins)

Very few people are good project managers. It’s owing to a fundamental mental error called the “Planning Fallacy”🤦🏽♂️

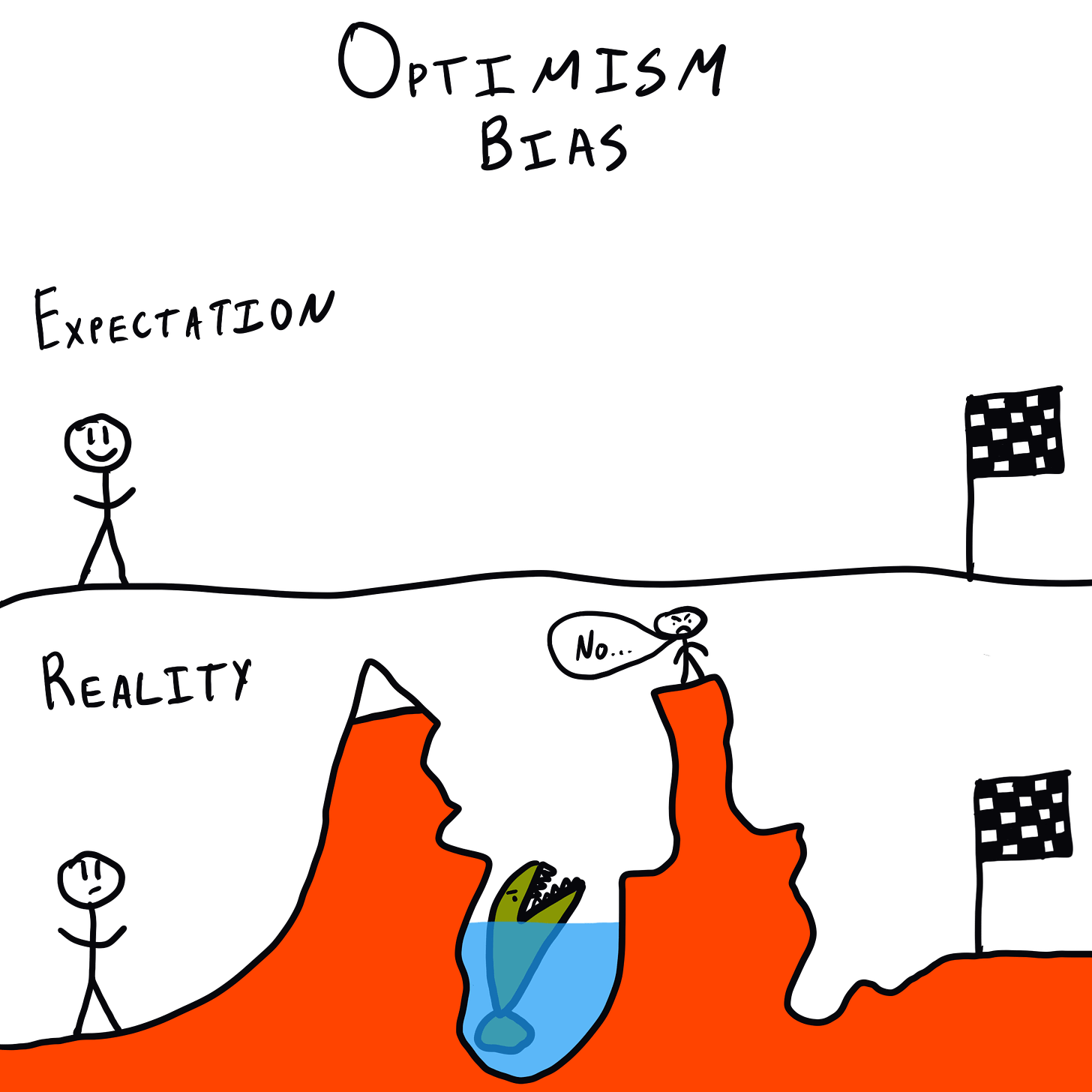

The planning fallacy is a phenomenon in which predictions about how much time will be needed to complete a future task display an optimism bias and underestimate the time needed.

There are a bunch of biases that show when we are planning a project:

Optimism bias: choosing only the “happy path” when estimating options

Wishful thinking: or Motivated Reasoning

Hasty generalization: making assumptions based on little evidence

Project Plans are super-complex especially large projects and it’s impossible to predict which path these projects will follow.

The complexity of almost any substantially meaningful plan is so high that it is impossible to take into account everything all at once.

Writing a plan is a great way to structure your thoughts, but implementing the very first initial plan most likely would be a terrible idea.

So, what can you do to be a better project manager?

🤏🏽 Deconstruct the project: Focus only on the variables you’re working on. Taking every next step based on the previous one that already works, would create a solid foundation grounded in reality.

🔭 Scout mindset: Instead of drawing a map of the new territory before the journey, consider drawing it step-by-step while exploring and learning at the same time.

🧠 Beware of the biases: The idea behind sharing these biases is to be aware of them. So, read more about optimism bias, wishful thinking, and hasty generalization to avoid them. Be cursed with knowledge.

🚶🏽♀️Why American Cities Are Not Designed For Pedestrians? (Video: 17 mins)

I love European cities because the city centres are walkable or cyclable🚲. If you live in the suburbs, you are still able to commute into the city using public transport. YOU DON’T NEED A CAR! 🚗🙅🏽♂️

🤦🏽♂️When you compare this with American cities, most American cities will require you to own a car. A person working minimum wage will have to always worry about owning a car. This is insane!

Also, they don’t look beautiful. It’s just large car parks and slabs of asphalt.

Not Just Bikes is a great channel (binge-watch the videos!) that breaks down urban planning and why American cities are built this way.

🎙PODCAST - COLD BREW MONEY

If you’re a listener, thank you so much!❤️

Can I ask you to share the podcast with one friend/family this weekend?

😲 Warren Buffett’s Spending Spree: Warren Buffett spent close to $40B in the first quarter of 2022. We look at the stocks he bought.

🏛️ University of Berkshire Hathaway: I recently finished reading the University of Berkshire Hathaway. Here are my favourite lessons.

Do you think any of your friends will like Monthly Mulling like you? Share it with them!😇

Thanks for reading. If you like Monthly Mulling, let me know. You can reach out to me on Instagram, Twitter, LinkedIn, or just reply to this email!