Hi👋,

Tapan here.

Monthly Mulling is a bi-monthly newsletter sending the best ideas from the web to your inbox for free. High signal. Low noise.

Happy Sunday everyone except to daylight savings!

It’s that time of the year when habits take a tumble and I feel lethargic. Last year, around the same time, I wrote about feeling stuck. A lot of y’all reached out saying you feel the same way. I had a plan last year to be more disciplined and I failed miserably. This year, I am a bit wiser. I have made peace with the cyclical lapse in motivation. Till the time you’re with your friends/family and taking care of your mental health, everything else can take a back seat for a bit.

Currently,

What I am reading: Early India by Romila Thapar

What I am listening: Udh Chaliye by Danny Zee

What I am watching: Dave Chappelle: The Closer

Onwards🚀

💭MULLING

💰 How Buffett Built His Wealth (AND IT’S NOT JUST READING!) by Neckar’s Insecurity Analysis (Read time: 13 mins)

You must have read this quote.

I just sit in my office and read all day.

- Warren Buffett

But it’s taken out of context a lot of times. Buffett didn’t just make his wealth by reading. There is one more key aspect to his wealth creation. Relationships.

Yes, knowledge does compound over time. But saying that Buffett built his empire just by reading is incorrect. Reading can teach you how to rule but it doesn’t teach you how you get to rule (Tweet this).

Your social network is very important. Buffett leveraged his relationships and discussed a lot of investment ideas with his friends.

Every two years, he gathered a group of friends which were originally dubbed the Graham Group or Grahamites and later became the Buffett Group.

The group … began in 1968 with 13 people and now has about 60, including Mrs. Graham, Munger, Murphy, Ruane, Tisch, Keough, Gates, Jack Byrne, and Lou Simpson. Sometimes Buffett refers to the group as ‘Our Gang’. During their retreats, the group holds seminars on public policy, investments, charitable giving (whether to do it early in life or late), life’s toughest and silliest moments.

- Of Permanent Value, The Story of Warren Buffett

Being politically correct, I will admit that there will be a lot of other factors that might have contributed to Buffett’s success but compounding wisdom and relationships feel like the biggest.

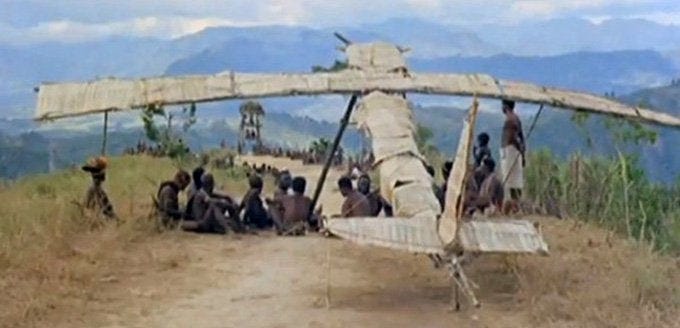

🤔 Cargo Cult Thinking by Paul Rulkens (Read time: 2 mins)

A cargo cult is when we imitate behaviours without understanding how they work in the hope of achieving the same results. It is the belief that if we simply emulate the visible effects of achievement, the real achievement will follow automatically.

The term cargo cult was first coined after World War II. During the conflict, several remote-island-based airfields were established in the Pacific for military purposes, baffling the indigenous, primitive populations. Often limited or no contact was established between the islanders and the more modern military forces. When the military finally left the islands, the original inhabitants tried to recreate the airfields using bamboo, stone, and other available material, waiting for the planes to return. Hence the name cargo cult thinking: If you build it, they will come.

Cargo cult thinking has a prominent place in modern business thinking as well. For instance, Elizabeth Holmes, the notorious CEO of Theranos, started wearing a black turtleneck to mimic Steve Jobs in order to practice a reality distortion of her own. Though initially very successful, as the scandals around Theranos have shown, what she actually did was mix cause and effect:

The rooster that crows in the morning doesn’t cause the sun to rise. Likewise, cajoling the rooster to crow earlier will not make a longer day.

Similarly, Richard Feynman has a great speech where he talks about Cargo Cult Science. If you haven’t heard the speech, I have linked it below. It’s also the final chapter of his book, Surely You’re Joking, Mr. Feynman! (my article on this book). Here is an excerpt from the speech.

The first principle is that you must not fool yourself – and you are the easiest person to fool. So you have to be very careful about that. After you’ve not fooled yourself, it’s easy not to fool other scientists. You just have to be honest in a conventional way after that.

So we really ought to look into theories that don’t work, and science that isn’t science.

- Surely You’re Joking, Mr. Feynman (Tweet this)

📚TREAT YO’ SHELVES

You can find my favourite books on my site and add me on GoodReads.

🧂 India After Gandhi by Ramachandra Guha

About the book: It took me a while to finish this 1200 page behemoth but man oh man, it was worth it. In my humble opinion, every Indian (or anyone interested in India) should read this book. Even if you don’t support the political opinion of the current or past regimen, it’s 100% a must-read.

As the title of the book suggests, the book covers a lot of subjects from 1947 until 2016 including the freedom struggle, problems after independence, poverty, literacy, the Kashmir and Nagaland issues, language, religion, caste, and almost every other thing. It walks you through the past circumstances under which certain decisions were taken and changes your outlook on a lot of current problems.

Guha does an incredible job of informing the reader of the scale of the task that was ahead, on the day India got its independence and taking the reader through this journey, chronicling events that have shaped present India.

Important Lesson: The most surprising part for me was India became a democracy despite the conditions under which the British left India. Some key challenges faced by India in 1947 - massive problem with illiteracy, famine and starvation, poverty, the partition, Kashmir riots, there were about 500 princely states, migration, religion, language barrier, untouchability, and caste. And still, India held a democratic election and set up somewhat of a progressive constitution (for that time and circumstance). This was all because of a few stalwarts.

In the post-Gandhian war for power the first casualty is decency.

💸 The Psychology of Money by Morgan Housel

About the book: One of my top five books on finance and investing (and part of our top 10 recommendations on CBM!). Housel, through the lens of history and personal tales, teaches us the most profound insights on the psychology of money - what it means to us, how we spend, save and invest, how we connect to who we are today to who we might be tomorrow

Important Lessons: The most important lessons are summarised in Chapter 19 of the book. Here are some favourites.

Savings are the difference between your income and your ego.

Manage your money in a way that helps you sleep at night.

Use money to gain control over your time.

If you want to do better as an investor, the single most powerful thing you can do is increase your time horizon.

Favourite Quote(s):

The biggest single point of failure with money is a sole reliance on a paycheck to fund short-term spending needs, with no savings to create a gap between what you think your expenses are and what they might be in the future.

When most people say they want to be a millionaire, what they might actually mean is “I’d like to spend a million dollars.” And that is literally the opposite of being a millionaire.

Studying history makes you feel like you understand something. But until you’ve lived through it and personally felt its consequences, you may not understand it enough to change your behaviour. We all think we know how the world works. But we’ve all only experienced a tiny sliver of it.

The line between “inspiringly bold” and “foolishly reckless” can be a millimetre thick and only visible with hindsight.

🎙PODCASTS

💰 COLD BREW MONEY

If you’re a listener, thank you so much! Can I ask you to share the podcast with one friend/family this weekend? It will really help us grow the podcast. We are now on YouTube too (if that’s your thing)! You can subscribe here.

☕ #69 – Book Summary: Coffee Can Investing Formula: Important lessons from Coffee Can Investing by Saurabh Mukherjea | Episode Page

📈 #70 – Ray Dalio’s Framework to Hedge For Inflation: We discuss inflation and how do you manage your portfolio during hyperinflation | Episode Page

👴🏽 #71 – How Much Money Do I Need For Retirement? Fireside Chat On Elon Musk Selling $TSLA Stocks & Web 3.0 | Episode Page

Do you think any of your friends will like Monthly Mulling like you? Share it with them!😇

If you like Monthly Mulling, let me know! You can reach out to me on Instagram, Twitter, LinkedIn, or just reply to this email!